Union Budget 2025: Key Highlights, Tax Updates & Analysis

In Union Budget 2025 Nirmala Sitharaman The finance minister of India announced Budget on 1st Feb 2025 which Introduced relief for middle class people

The finance minister announced that there will be no tax payable on the Income Up to 12 Lakh which give massive relief to middle class people , Salaried Individuals in India get Higher Tax free Income Limit of 12.75 lakh due to the Standard Deduction of Rs 75000

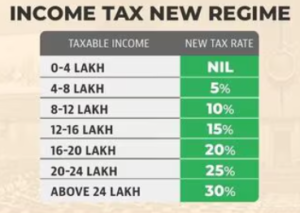

Union Budget 2025 income tax slabs:-

Under the new tax slab regime, do not be misled by the slab rates , Individual with an income of up to Rs 12 lakh are eligible for a rebate.

Union Budget 2025 The new Tax slab rate has introduced to significantly lower middle class taxes and boost household consumption , Savings And Investments.

Infrastructure Development in Union Budget 2025

In Union Budget 2025 The Government has announced initiative aimed at boosting affordable housing, urban development and Infrastructure.

SWAMIH Fund 2: 15000 Crore for Affordable Housing

The Special Window For Affordable mid -Income Housing (SWAMIH) fund 2 has been introduced to provide Financial Assistance for paused housing housing Projects.

this initiative is expected to complete 1 lakh pending homes , ensuring home buyers receive their long Awaited properties.

this 15000 crore fund will boost employment in the construction sector and stimulate economic activity in urban areas.

1 Lakh crore urban Challenge Fund: Developing Growth Hubs

A 1 lakh crore urban challenges fund is introduced to promote planned urbanization in smaller cities.

This Fund aims to Transform tier 2 and tier 3 cities into Growth hubs, this will improve Infrastructure business opportunities and living standards.

The purpose is to decongest the metro cities and create more balanced regional development.

Jal jeevan Mission Extended until 2028

Jal jeevan Mission was Launched by Prime minister Narendra Modi on August 15, 2019 to Provide 100 percent Tap coverage to every rural household by 2024 has been extended until 2028

this Extension ensures that every rural household get access to clean drinking water , Improving Health, Sanitation , and overall quality of life.

Union Budget 2025 Highlights :

The Union Budget 2025 Focuses on strengthening India’s Travel and transportation infrastructure with major investment across air , water and land transport

Expansion Of the UDAN Scheme

120 New Destination added to boost regional air connectivity, making air travel more accessible and affordable

25000 crore maritime development fund

significant investment in shipbuilding, port expansion and modernization to enhance trade and maritime logistics.

Development of Coastal and Inland waterway transport to reduce logistics costs and boost exports

Major investments in urban and road transport

Expansion of metro network in key cities to improve urban mobility and reduce congestion.

New Highways and expressway projects for faster, more efficient transportation across states.

Education

the Government is set to establish 50000 atal thinkering labs in schools across country to foster creativity, critical thinking and innovation in students. This Initiative aims at enhancing STEM Education, will focus on emerging technologies such as Artificial Intelligence (AI).

Centre of Excellence in AI for Education

In Education to promote AI the government is planning to establish a centre of Excellence For AI. This will serve as hub for research , training and the development of AI Based Solution to enhance the quality of education across India.

Expansion In Medical & Engineering Education

the government has announced the addition of 10000 new medical seats in 2015 , this will offer more opportunities for student aspiring to the medical field, also an expansion of engineering seats is also planned.

Electricity & Energy : Push for nuclear & Green power

Union Budget 2025 , the Govt Allocates ₹20,000 Crore for Small Modular Reactors, Announces EV & Renewable Energy Boost

the government has earmarked ₹20,000 crore for the development of Small Modular Reactors (SMRs) as part of its Nuclear Energy Mission

Cheaper EVs: Duty Cuts on Lithium-Ion Battery Components

To make electric vehicles (EVs) more affordable, the government has reduced duties on lithium-ion battery components. This move aims to lower production costs for EV manufacturers, ultimately making electric cars and two-wheelers more accessible to consumers.

Custom Duty Exemptions on Capital Goods for EV & Mobile Batteries

the government has exempted customs duty on 35 capital goods used in the production of EV batteries and mobile batteries. This will help reduce manufacturing costs and attract more investment in the sector.

Push for Green Energy & EV Battery Manufacturing: the government has announced subsidies for EV battery production, solar panel manufacturing, and wind turbine development. These incentives aim to boost domestic manufacturing, reduce reliance on imports, and make renewable energy more affordable.

Jobs & Business: Boost for MSME & Startups

In a major push for entrepreneurship, the government has announced a ₹10,000 crore Fund of Funds to support startups across various sectors. This initiative aims to provide financial backing and encourage innovation-driven businesses in India.

MSME Credit Guarantee Doubled

The credit guarantee limit for Micro, Small, and Medium Enterprises (MSMEs) has been doubled from ₹5 crore to ₹10 crore. This move is expected to ease access to credit, allowing small businesses to expand operations and improve financial stability.

Special Support for Women & SC/ST Entrepreneurs

To promote inclusive growth, the government will offer term loans of up to ₹2 crore to women and SC/ST entrepreneurs. This initiative is designed to empower underrepresented business owners by providing them with the necessary financial support to scale their ventures.

Economic Market Stability

In Union Budget 2025 , The government has successfully reduced the fiscal deficit to 4.4% of GDP, down from 4.8% , reflecting better financial management and a stronger economic outlook.

the Foreign Direct Investment (FDI) limit in the insurance sector has been increased from 74% to 100%. This reform is expected to bring in more foreign investment, enhance competition, and improve insurance services for consumers.

Union Budget 2025 ,The government has opted for lower capital expenditure this year, a decision that signals a shift towards fiscal prudence. While spending has been curtailed, the priority remains ensuring that financial resources are used efficiently, with a focus on long-term economic stability. RBI Monetary Policy and it’s Instruments

Despite no relief on capital gains tax, the government’s focus remains on stability in tax policies, ensuring a predictable investment climate for long-term growth.

The Union Budget 2025, stocks in sectors like infrastructure, renewable energy, and electric vehicles are expected to benefit, including companies like Larsen & Toubro, Tata Power, and Mahindra Electric.t the increase in FDI limit in insurance will likely boost insurance stocks such as ICICI Lombard and SBI Life. Additionally, the fund for startups and MSME credit guarantees could drive growth for companies like Tata Motors, Bajaj FinServ, and Godrej Agrovet. Financial institutions like HDFC Bank and ICICI Bank may also perform well due to rising credit demand and fiscal discipline.

Official Budget Portal: https://www.indiabudget.gov.in/